Got the bear market blues? You’re not alone. While markets have had an unusually tough first-half of the year, all is not lost.

A picture is worth a thousand words, so instead of getting into a bunch of economic jargon that will put most of you to sleep, let’s keep it visually simple. Hat tip to acquaintance Jim Bianco for the graphs.

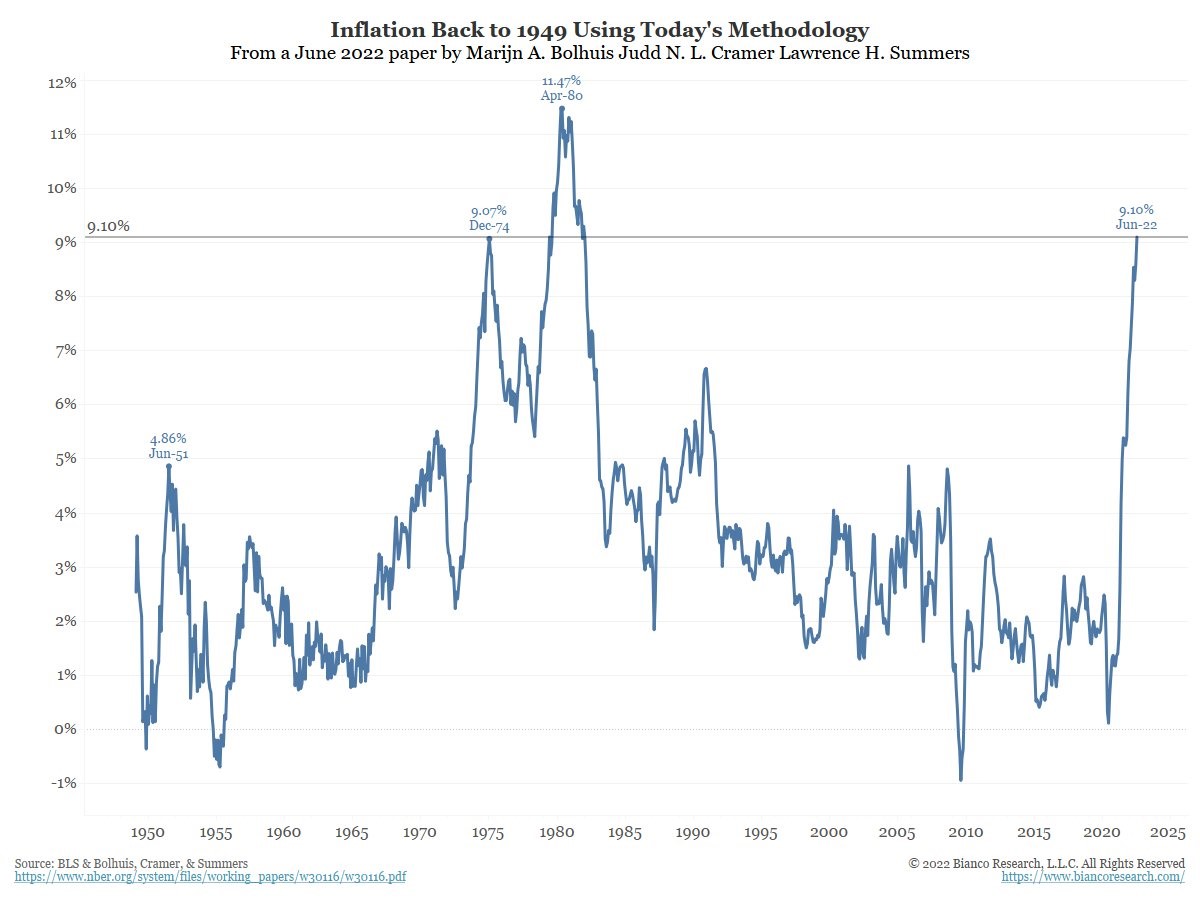

First, let’s look at inflation going back to 1949 using today’s methodology:

As you can see, inflation is at a record level that hasn’t been seen in decades.

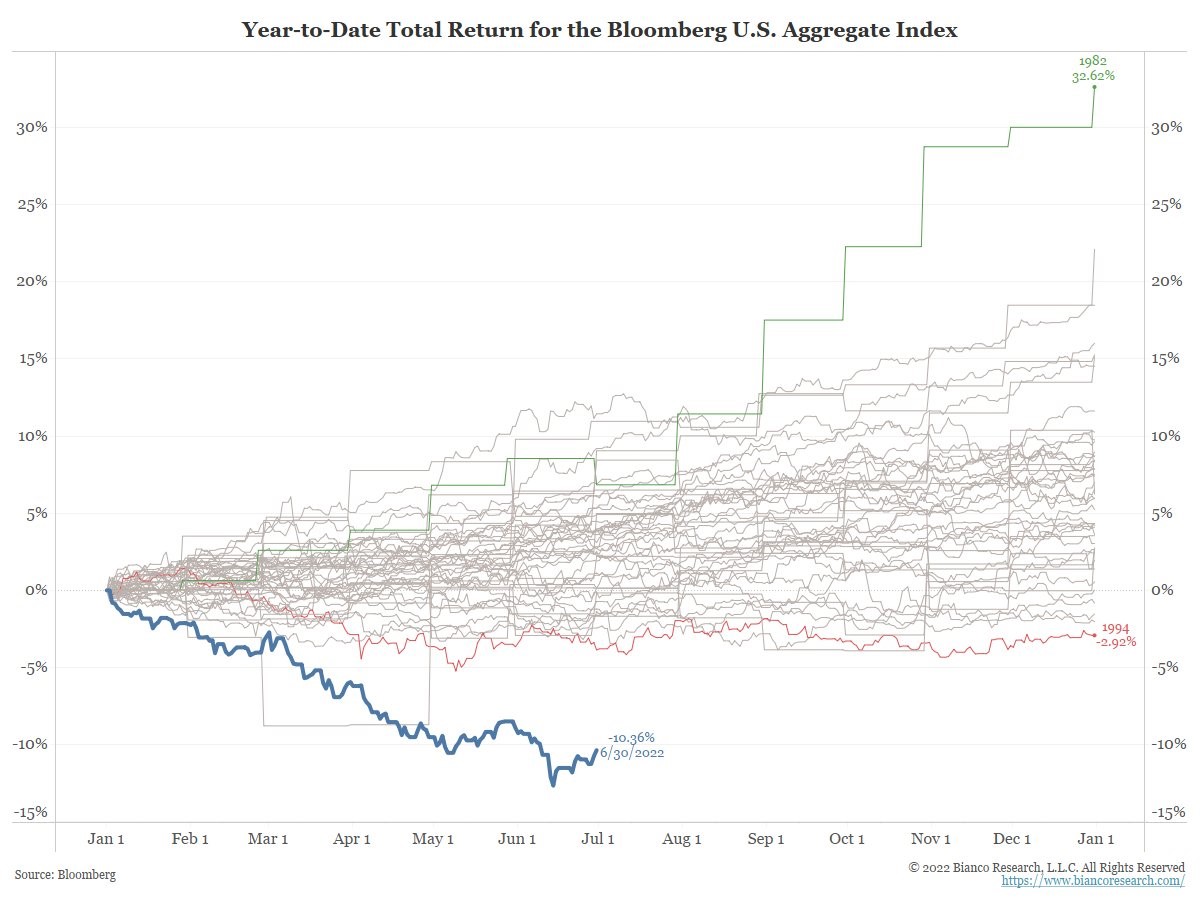

Next, let’s look at the sleepy bond market as represented by the Bloomberg U.S. Aggregate Bond Index. This is the year-to-date total return for the index.

Notice the outlier at the bottom in blue? That’s this year. With data going back to 1976, this is clearly the worst start to any year for bonds since the data set began.

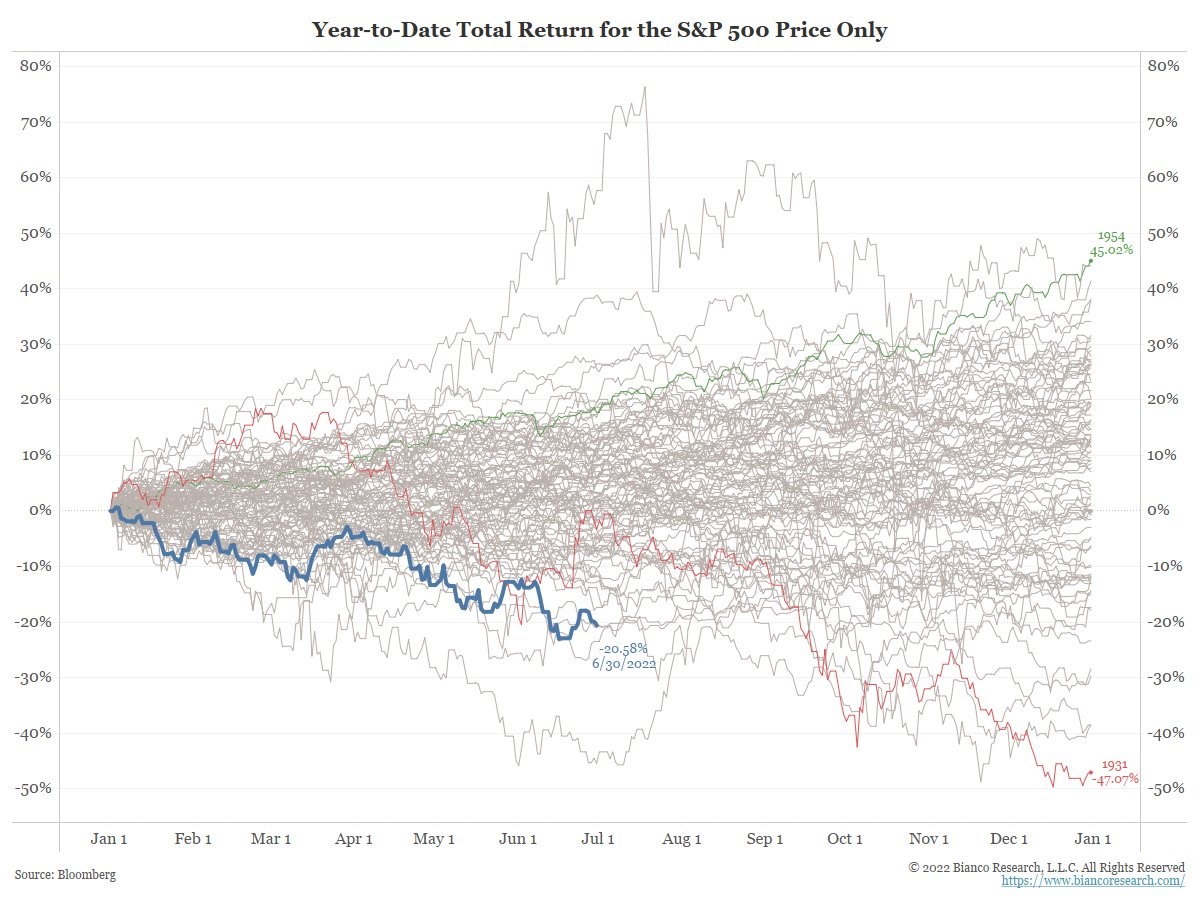

Now let’s look at stocks as represented by the S&P500. This is the year-to-date total return for the index, excluding dividends (meaning, price only).

While not the worst start to a calendar year, it’s clearly toward the bottom of the data set. Many of the high-flying tech names that did so well when interest rates were at zero are down even more.

Taken together, we can understand that for diversified portfolios that hold both stocks and bonds, the bond portion has not served as a stabilizer against this year’s selloff in stocks because both stocks and bonds have gone down together, which is unusual.

We’ve been through many bear markets before. A bear market is when stocks are down 20% or more from a previous high. Prudent investing principles show that one of the worst things to do in a bear market is panic and go to all cash because market timing is virtually impossible. When we look at previous bear markets, the time when markets felt the scariest were, historically, great buying opportunities. So, what are we to do?

Bear markets offer us an opportunity to employ certain strategies that are more attractive when portfolios are down, and that’s the crux of today’s message. Here they are, in no particular order of importance.

Having Ample Reserves for Short-Term Expenses

First things first: it’s important to have ample savings in holdings that won’t fluctuate much with the stock market or interest rate changes. This doesn’t necessarily mean having a huge cash position; rather, it means having reserves in something like a money market fund that will cover your expenses for a year or two. This way, you don’t have to sell large portions of your portfolio while those holdings are at depressed values.

Tax-Loss Harvesting

This is a strategy when we sell investments that are down to take what is an on-paper loss and convert it to a “tangible” loss for tax planning purposes. The benefit is that we can create a loss that we can carry forward on your tax return. This allows us to use the carry-forward loss to credit future capital gains.

We can also sell other investments that are at a gain in a “tax neutral” way that allows cash to be created without causing a capital gain, which allows the resulting cash to be used to rebalance the portfolio. This maintains the integrity of the portfolio so that it is not out of balance.

Reducing Investment Costs

Many investors bought or were sold expensive, tax-inefficient stock mutual funds that kick capital gains onto the Schedule D of their tax return. One of the primary pain points of our clients when they first come to the firm is that they have annoying—and often expensive—capital gains resulting from these mutual fund holdings. Tax-loss harvesting can be done with these expensive, tax-inefficient mutual funds to create cash that can be redeployed in much lower cost, more tax-efficient holdings. The cost and tax savings can really add up over time, which means more money is left in your wallet.

For more information on tax-loss harvesting and reducing investment costs, please see my CNBC article.

Roth IRA Conversions

Roth conversions are really important to consider in a bear market. One of the benefits of a Roth IRA is that the Roth assets can grow tax free and be taken out completely tax free in retirement if you are age 59.5 and the assets have been in the account for a full five years. Converting some of your IRA during a bear market is worthy of consideration because you are able to convert while valuations are depressed. This gives the assets that you convert from a traditional IRA into a Roth IRA the opportunity to participate in the eventual market recovery.

Required minimum distributions (“RMDs”), which is what you are generally required to take out every year from a traditional IRA, SEP IRA, Simple IRA, or retirement plan account that is not a Roth, now start at age 72. These RMDs are taxed as ordinary income. However, for Roth IRA, there are no RMD. This means that the more you have in a Roth—and thus the less you have in the previously-mentioned retirement accounts, the less you have to take in RMDs that are taxed as ordinary income. This can save you a lot of taxes throughout retirement.

Further, one of the nuances of the SECURE Act that was passed in 2019 is that non-spousal heirs of an IRA—unless they meet few strict exceptions—is that the non-spousal heir (such as your adult children) have until the end of the 10th year after inheriting your IRA or 401k account to withdrawal all the funds in that account. The problem is that these withdrawals are all taxed as earned income. Thus, if the non-spousal heir is in a higher-than-average tax bracket, this becomes a tax-inefficient way to transfer your assets.

Those Roth IRA assets grow tax-free and can be passed to heirs tax-free; further, while the non-spousal heir of the Roth IRA is still required to withdrawal all the money from that account by the end of the tenth year, that heir can withdrawal the funds at the end of the tenth year completely tax free. This means that the assets in that account have a full decade to grow completely tax free before having to be withdrawn. This is smart planning.

There are nuances to the Roth IRA conversion strategy that are too detailed for this post, so it’s important for us to talk about your tax profile and some of the stipulations of the Roth conversion before you implement this strategy.

Portfolio Rebalancing

In a bear market, a portfolio’s holdings often become out of balance relative to what they should be. For example, an investment that should be 12% of a portfolio might be 10% of the portfolio in a bear market. Thus, it’s important to rebalance a portfolio when it is down so that the investments can be realigned to the appropriate percentages. This helps maintain portfolio diversification and position the allocation for the eventual recovery.

The Federal Reserve has maintained that it will continue to raise interest rates to fight inflation. The effects of the Fed’s interest rate raises are already being seen throughout the intentional slowing of the economy. Going back to 1981, lyrics from Dolly Parton’s “9 to 5” come to mind:

In the same boat with a lot of your friends

Waiting for the day your ship will come

And the tide’s gonna turn an’ it’s all gonna roll your way

In due time, I do believe this will be the case. This is the first inflationary environment that we’ve seen in decades. The key is to hang in there, take advantage of the opportunities presented by this bear market (future you will thank current you!), and let time do its thing.

As always, I invite all questions that come to mind.

In gratitude,

Vance