The transition into 2020 marked the beginning of not only a new year, but a new decade. It also started the very short time clock to when I turn the big 4-0. Yes, the big FOUR ZERO. This “new year, new decade, wow this is forty” thinking prompted reflection on the last decade – and the “lost decade” – both of which I’ll discuss on stage at *Inside ETFs.

In mid-2007, I began serving as an alternative investment consultant to leading private wealth and retail financial advisors. In that role, I would introduce alternative investments as diversifiers or “hedges” aimed at delivering portfolio diversification. Many advisors metaphorically told me to pound sand because the economy was “booming”. What was so fascinating is how many of these same advisors were calling me in early 2009 wanting to invest their clients’ money into the very strategies that had weathered the storm of 2008. Looking back, that’s like putting a seatbelt on after a crash.

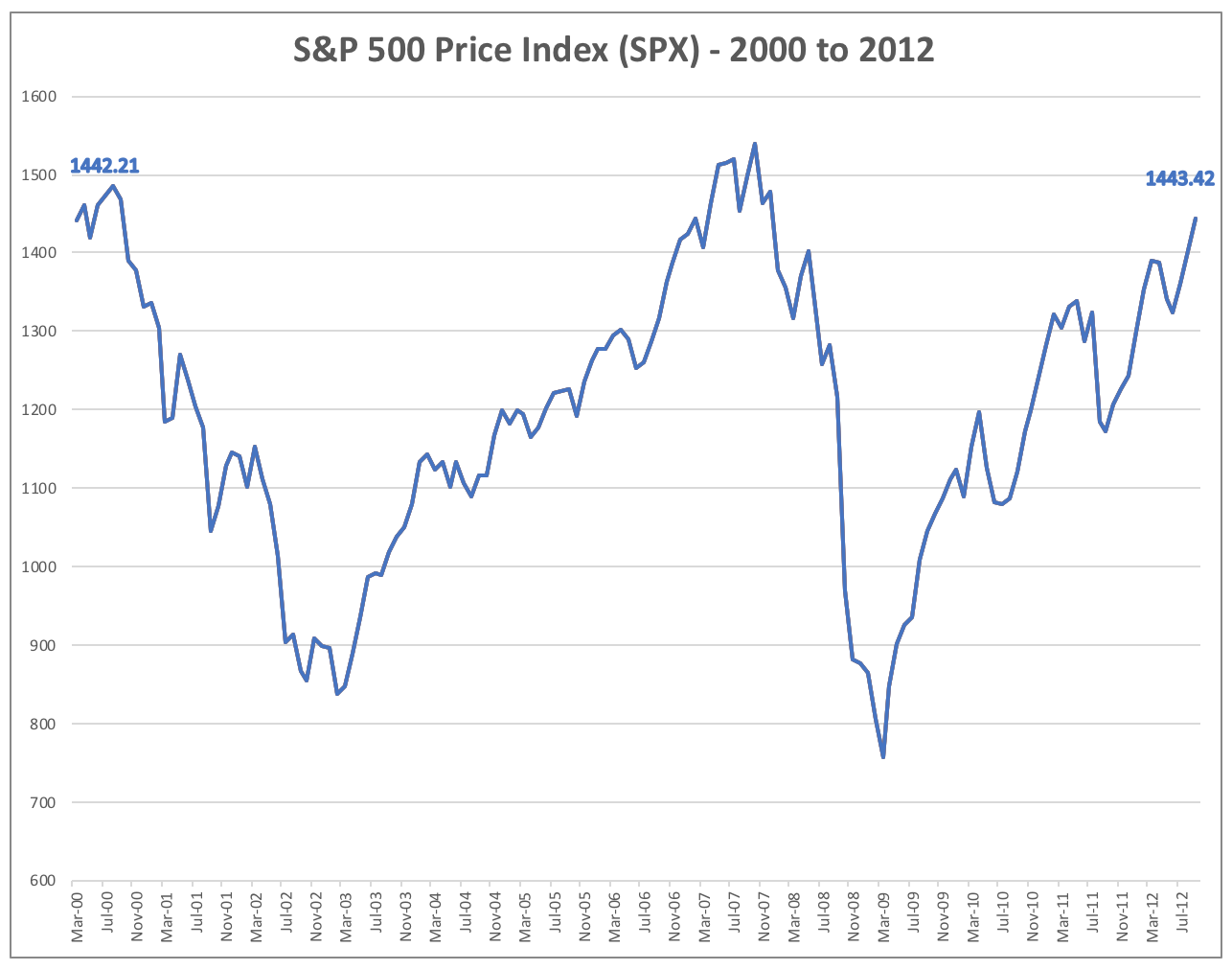

The term “lost decade” emerged after 2008 when charts depicted how equities were flat from the Dot Com era peak to the Credit Crisis peak (excluding dividends). In the first few post-2008 years, alternatives were a hot dot: advisors and investors were often drawn to their performance during the lost decade. Several asset managers began providing so-called “liquid alts” and the number of offerings ballooned. I found myself on the forefront of the evolution of alternative investments from private placements into “liquid alternative” mutual funds and felt very fortunate to spend time with many well-known economic thought leaders. I also learned way more than I bargained for about financial advisors and the inner workings of the financial services industry.

The “Lost Decade” (excluding dividends). Source: Investing Par Excellence.

Unfortunately, advisors and investors were often unfamiliar with what was under the hood and weren’t versed on the nuances of different “alts” strategies. Some strategies worked while others left advisors and investors with buyer’s remorse. “Alts never work!” was something I commonly heard from those who allocated to them only after corrections. They seemed to forget three key reasons why alts are added to portfolios: they strive to offer noncorrelation, lower portfolio volatility, and diversification.

My view on alternatives has evolved over the last decade. If you’re a non-institutional investor, have a long-term time horizon, and don’t need your long-term money in the short-term, what’s the concern over market volatility? It is now my opinion that, for most retail investors, the best “hedge” against an equity market downturn is not having more than your appropriate exposure to equities. This is coming from a guy who spent thousands of hours consulting financial advisors on how to use alts for their clients. Yet, financial advisors often serve discerning high-net-worth investors who see value in these strategies.

Liquid alts have a place in certain portfolios, and here’s why: several of these strategies have historically helped mitigate downside risk during periods of crisis (most recently in Q4 of ’18); historically helped dampen overall portfolio volatility; and can provide return streams that are different than those from stocks, bonds, and real estate. But the space is large and often confusing. The challenge for many advisors and investors is understanding which strategies to employ, where to put them in a portfolio, and how to manage expectations. With the stock market notching new highs in the longest bull market on record, is now a good time to revisit these strategies?

I don’t know what the next decade has in store, but I’m really looking forward to moderating the “Liquid Alternatives, Your Portfolio, & the Future: What You Need to Know” panel with Shana Sissel, Phil Huber, and Bill DeRoche. This line-up of great minds promises to offer key insight and booming personalities while demystifying an often-misunderstood asset class. And sticking to the decade theme, I am in absolutely no rush to get to age 50.

Disclaimer: please consult a financial advisor with expertise in these strategies to evaluate if they may be suitable given your investment objectives. Please also consult a tax professional regarding the tax implications of investing in these strategies. Investing in alternative investments may not be suitable for all investors and involves special risks, such as risk associated with leveraging the investment, adverse market forces, regulatory changes, and illiquidity. There is no assurance that the investment objective will be attained. *Inside ETFs is exclusively for financial professionals.

D. Vance Barse (CA Insurance #0L70885) is an investment adviser representative with and offers advisory services through Commonwealth Financial Network®, a Registered Investment Adviser.